Slower condominium completion in 2023 – Colliers

Leading diversified professional services and investment management firm Colliers (NASDAQ and TSX: CIGI) sees muted condominium completion in 2023 due primarily to elevated interest and mortgage rates, as well as rising prices of construction materials, which recorded a 14-year high in 2022.

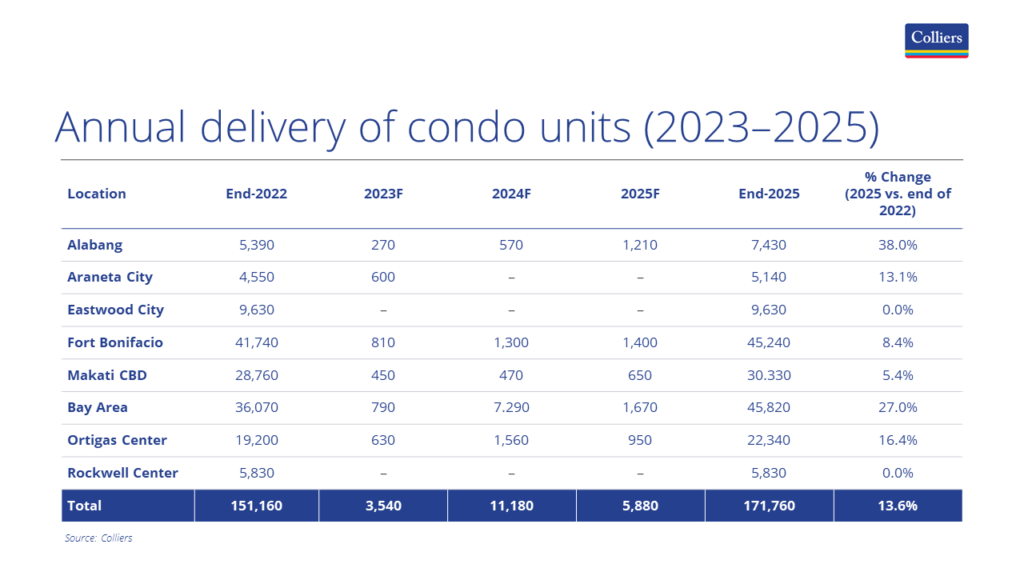

Colliers’ projected condominium completion in 2023 is just about a third of total units completed in 2022. Meanwhile, Colliers sees condominium completion bouncing back in 2024, with the delivery of more than 11,000 new condominium units across Metro Manila.

“We project the Bay Area dominating condominium supply across Metro Manila in 2024 as we see the business district overtaking Fort Bonifacio in terms of condominium stock,” said Joey Roi Bondoc, Colliers Director of Research. “By end-2024, the Bay Area will have about 44,200 condominium units versus Fort Bonifacio’s 43,800 units and the Makati CBD’s 29,700 units. By end-2024, the Bay Area is likely to account for 27% of Metro Manila’s condominium stock versus Fort Bonifacio’s 26% and Makati CBD’s 18%.”

In Q1 2023, Colliers recorded the completion of 1,200 units, down 70% quarter-on-quarter. Among the projects completed during the period include Megaworld’s The Ellis in the Makati CBD and Manhattan Plaza Tower 2 in Araneta City; Federal Land’s Mi Casa Hawaii in Bay Area; and Keyland Corporation and Ascott Limited’s 110 Benavidez in Makati CBD. In 2023, Colliers projects the delivery of 3,540 units, down 61% from the 8,970 units completed in 2022. The Bay Area and Fort Bonifacio will likely account for nearly half of the new supply this year.

Demand in the secondary market improving

The demand for condominium units in the secondary market is improving due in part to improving take-up from local professionals and expatriates. This has been resulting in marginal improvement in vacancies across Metro Manila. Colliers sees continued recovery of rents and prices across the capital region although still below pre-Covid-19 pandemic levels. Pre-selling condominium take-up in Q1 2023 provides some optimism, but slower launches remain prevalent as developers hold off new project launches due to a high interest rate environment and elevated prices of construction materials.

Opportunity to rent condominium in major business districts

With prevailing rental corrections in major business districts, Colliers believes that now is an opportune time for tenants to rent condominium units in key business hubs across Metro Manila. As of Q1 2023, lease rates for studio and one-bedroom residential units have declined by more than 40% in the Bay Area. We attribute this to dampened demand from local professionals as well as exodus of Chinese employees from the offshore gaming sector.