China Bank nets P12.1 billion in 2020, up 20%; hits P1 trillion in assets

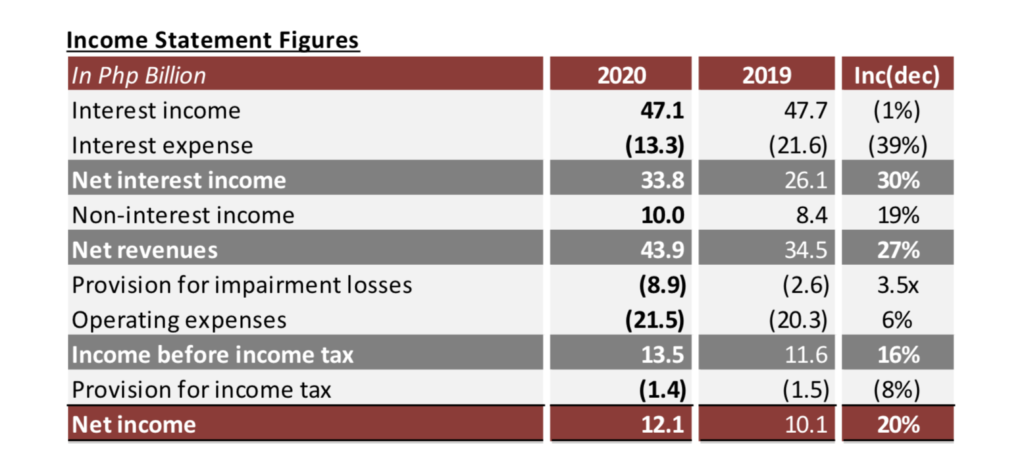

China Banking Corporation (China Bank, PSE symbol: CHIB) concluded a challenging year with P12.1 billion net income, 20% higher compared to 2019. The bigger profits translated to an improved return on equity of 12.1% from 11.0%, and a better return on assets of 1.2% from 1.1%.

The strong growth in core businesses and better investment and trading returns offset the Bank’s pandemic-related loan buffer of P8.9 billion, which was 3.5 times higher than in 2019.

Net interest income surged by 30% to P33.8 billion on the back of the 39% drop in interest expense, resulting in higher net interest margin of 3.92%. Non-interest income grew by 19% to P10.0 billion, lifted by trading and securities gains which expanded more than double in 2020 to P5.4 billion.

Sustained efforts in cost management kept the growth of operating expenses controlled at 6% to P21.5 billion. Cost-to-income ratio improved to 49% from 59% as income growth continued to outpace expense growth.

“Going into the crisis, China Bank was operationally and financially sound, but what enabled us to remain resilient and to sustain our growth momentum was our employees who went above and beyond in 2020,” said China Bank President William C. Whang. “Our relentless efforts to build and maintain robust liquidity and capital levels have positioned the Bank well to weather the ongoing storm, and at the same time, to help our customers and the country recover.”

China Bank’s total assets stood at P1.04 trillion, up 8%.

Deposits increased by 8% to P835 billion, underpinned by 14% growth in checking and savings accounts (CASA). Healthy CASA deposit generation eased the Bank’s overall funding cost and led to a better CASA ratio of 56%. The Bank’s successful fund raising via the issuance of P15 billion fixed-rate bonds in October 2020 also helped improve funding flexibility. This was followed by another oversubscribed bond offering worth P20 billion, issued and listed last February 18, 2021.

Gross loans ended flat at P572 billion as business customers reduced loan drawdown. Consumer loans grew 7%, accounting for 20% of the total loan portfolio. Non-performing loans ratio rose to 2.3%, in line with the Bank’s expectations, but NPL cover remained sufficient at 128%.

“We continue to support our customers through the uncertainty of COVID-19, providing credit, debt relief, and payment moratorium while ensuring capital and liquidity preservation. We have formulated strategies to mitigate asset quality issues given the possibility of a drawn out pandemic,” said China Bank Chief Finance Officer Patrick D. Cheng.

The Bank’s capitalization increased by 9% to P105 billion, with a Common Equity Tier 1 (CET1) ratio of 13.82% and total Capital Adequacy Ratio (CAR) of 14.73%, both above the minimum regulatory requirement.

In 2020, China Bank commemorated its 100th anniversary with the theme, “Celebrating the Past. Embracing the Future.” It launched a year-long deposit promo and its “Times Change but Values Remain” ad campaign on cable TV and social media, and unveiled the restored façade of its original head office in Binondo, which was built in 1924. The Bank also rolled out a Centennial Stock Grant Plan which gives qualified employees 100 China Bank shares for every year of service. It also signed its 26th collective bargaining agreement with the CBC Employees’ Association for years 2020 to 2022.

China Bank’s centennial celebration program was awarded a Gold Anvil at the 56th Anvil Awards of the Public Relations Society of the Philippines.

China Bank was again recognized for its excellence in corporate governance. The ASEAN Capital Markets Forum named the Bank as among the top 3 publicly listed companies (PLCs) in the Philippines, among the top 20 PLCs in ASEAN, and as an ASEAN Asset Class for 2019; while the Institute of Corporate Directors distinguished the Bank with a 4-Golden Arrow recognition, the only bank among the six awardees.

[Investing? Get MoneySense’s 2021 Investing Issue featuring investment guru Ron Acoba here]

Other stories: