China Bank 1H 2022 net income grows 39% to P10.1B

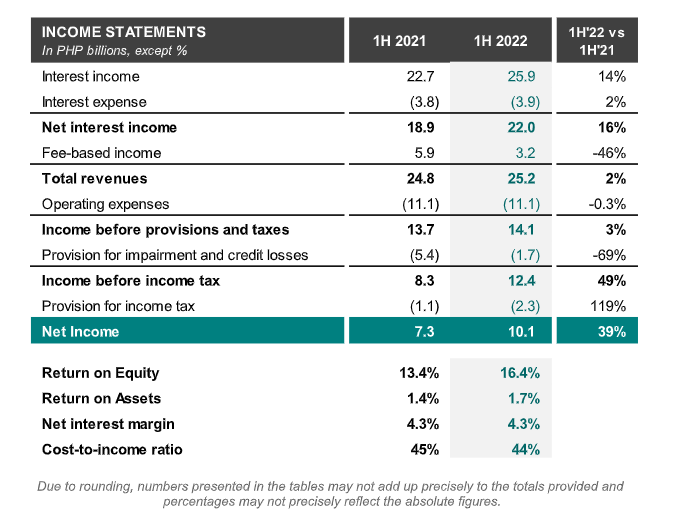

China Banking Corporation (China Bank, PSE stock symbol: CHIB) posted P10.1 billion in net profit in the first six months of 2022, up 39% compared to the same period last year, driven mainly by higher net interest income and core fee income, as well as lower provisions. The robust income performance translated to a better return on equity and return on assets at 16.4% and 1.7%, respectively.

Net interest income rose 16% to P22.0 billion on the back of stronger top line revenues and steady movement in interest expense. As a result, net interest margin was maintained at 4.3%. The decline in trading and foreign exchange gains weakened fee-based income to P3.2 billion. Nevertheless, core fee income increased 24%, driven mainly by double-digit growths in service charges, fees, and commissions, income from sale of acquired assets, and bancassurance.

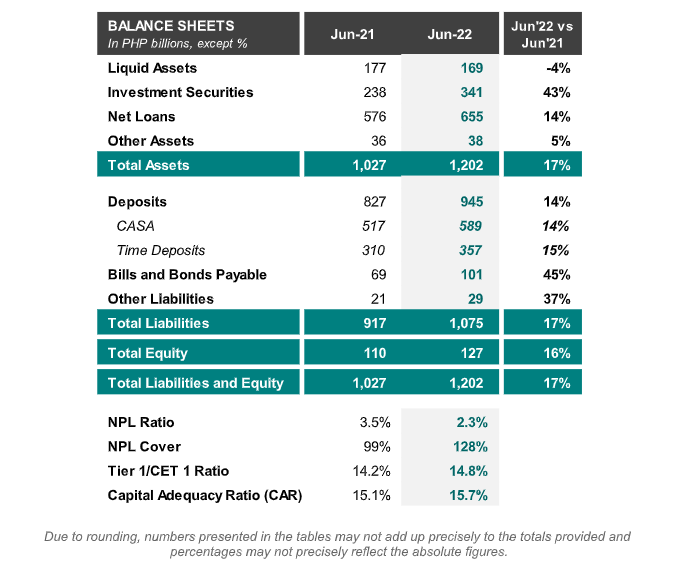

Reflecting its positive economic outlook and its improving asset quality, the Bank reduced its credit provisions by 69% to P1.7 billion. Gross non-performing loans (NPL) ratio was at 2.3%, 120 bps lower versus last year and better than industry average. Meanwhile, NPL cover remained sufficient and above industry at 128%.

Efficiency enhancements and judicious cost management kept operating expenses flat year-on- year, further improving cost-to-income ratio to 44%. “The sustained growth puts China Bank in a stronger position to support customers and the economy in this period of recovery,” China Bank President William C. Whang said.

Throughout the pandemic, the Bank has consistently recorded quarterly income growth. “For the 2Q 2022 period, China Bank’s net income breached the P5-billion mark, a first in the Bank’s more than 100-year-old franchise,” Chief Finance Officer Patrick D. Cheng said.

China Bank remains one of the largest banks in the country. As of June 2022, consolidated assets were recorded at P1.2 trillion, up 17%. Loans expanded 14% to P655 billion on the back of significant growths in both business and consumer loans. Total deposits likewise increased 14% to P945 billion, as the Bank sustained a 14% year-on-year build-up in current and savings accounts.

Total equity jumped 16% to P127 billion with Common Equity Tier 1 Ratio and Total Capital Adequacy Ratio of 14.8% and 15.7%, respectively, well above the minimum regulatory requirement.

On the strength of its capitalization and profitability, China Bank’s investment grade credit rating with stable outlook was recently affirmed by Moody’s Investors Service. China Bank also received the highest credit rating of PRS Aaa (corp.) from Philippine Rating Services Corporation (PhilRatings). The rating takes into account the Bank’s established track record and resiliency, sound funding profile, more than satisfactory asset quality, and ample capital buffer.

The Bank’s digital transformation is progressing as planned, marked by the launch of its mobile account opening app, China Bank START, and the roll-out of its stock trading platform, ChinaBankSec Online, in the second quarter.

Meanwhile, China Bank Easy Tax Filing and Payment Solution (Easy Tax), the first and only automated collection facility in the country specifically for real estate developers, was named as the Best Digital Business Banking Initiative 2022 by Hong Kong-based magazine Asian Banking and Finance. The awarding is slated in August, coinciding with China Bank’s 102nd anniversary.