Cashalo Launches Cash Academy – a National Financial Literacy Program for all Filipinos

Cashalo, a leading fintech platform that provides loans through a mobile app, today launches CashAcademy, it’s nationwide financially literacy program with the aim of developing a generation that is more financially literate knowledgeable, responsible, and empowered.

The program currently provides eight free learning modules available in the form of short videos on their site. The program include topics on the following:

- Setting Financial Goals

- Responsible Borrowing

- Managing your money and income

- Entrepreneurial Mindset

- Developing Entrepreneurial Skills

- Business Plan Development

- Sourcing Capital

- Government Regulations and Support

The videos are of high quality, insightful, engaging and relevant. Below is a description of the content of one of the modules.

Setting Financial Goals

The module starts with asking the individual about their current financial state, whether they are Struggling (Barely getting by), Surviving (Worried about the future), Stable (Making ends meet), Secure (Having enough), Surplus (Having more than enough) and encourages individuals to have a positive mindset about their finances.

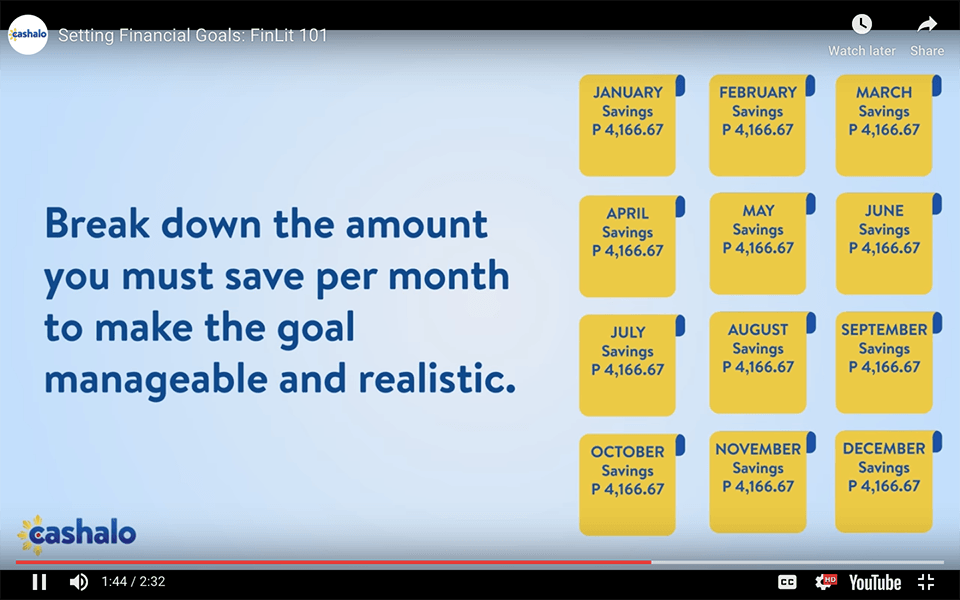

It identifies that financial problems are a result of financial management problems. It puts Budgeting in a positive light, informing the viewer that having a budget gives them control over where their money goes; and encouraging them to spend within their means. Moreover, it encourages Saving, giving importance to paying ourselves first. It further highlights the importance of having SMART (Specific, Measureable, Achievable, Realistic and Timebound) financial goals, breaking it down into What (Business, Career, Financial goals), Why (Financial Security, Future of the family), and How (Concrete plan and multiple sources of income). It also classifies goals into short (1-2 years), medium (3-5 years) and long term (5+ years). Giving the goal of saving P50,000 in one year as an example, it advises breaking down the goal into a monthly amount to save per month to make it more manageable and realistic.

It contrasts the goal of: “I plan to buy a house” with “I will save 1 million pesos in 5 years to make a downpayment for a house and lot for my family”. It then summarizes the main ideas of the module: Craft smart financial goals, make a realistic plan and stick to it, and develop multiple streams of income. Finally the module ends with a thoughtful saying: “The only difference between a dream and a goal is a plan”.

After watching the videos, visitors are invited to take a localized version of the World Bank 7-point financial literacy quiz that gauges their basic financial understanding and know-how. Those that pass the quiz will be given a digital certificate to signify that they are financially literate.

In Partnership with ASSIST Asia, Google, the Department of Trade and Industry (DTI) and Go Negosyo, Cashalo has already delivered online and offline financial literacy and business skills training through the beta phase of the Cash Academy initiative to over 100,000 Filipinos to date.

CashAcademy forms a critical aspect in Cashalo’s mission to accelerate financial inclusion and supports the BSP’s efforts to improve financial literacy in the Philippines.