MoneySense Q3 2024 Features: Richard Carvajal – Property Entrepreneur

The Millennial Property Entrepreneur

How Richard Cavajal’s go-getter attitude and digital savvy led to his real estate success

By EXCEL V. DYQUIANGCO

At a time when most young people are still trying to figure out their career paths, Richard Carvajal has not only found his calling but thrived in it. At just 23, Richard had already made his million from real estate. Today, he’s a successful entrepreneur, property investor, content creator, and personal finance advocate.

Ironically, real estate and entrepreneurship were never on Richard’s radar. He once aspired to be a dentist, fascinated by the profession since childhood. While most kids dread the dentist’s chair, Richard was a fan. “I initially wanted to take up dentistry because I loved going to the dentist as a kid,” he recalls with a grin.

But a scholarship at Enderun Colleges set him on a different path. There, he studied International Management, majoring in Hotel Administration, a world far removed from his childhood aspirations. Little did he know, this academic detour would lead him straight into the heart of real estate and finance, where he would forge a new identity, advocate for financial literacy, and mentor the next generation of entrepreneurs.

From Corporate to Real Estate

Richard’s introduction to real estate came during his college years when a friend working as a real estate agent involved him in property referrals. Although his role was limited to making introductions, this experience planted the seed for his future endeavors. “That was what I did in college – referred them to my friend,” he shares.

After graduation, Richard worked in Human Resources at a 5-star hotel, managing expat housing—a role that gave him valuable insight into the property market. This exposure to property management and market prices proved invaluable, serving as the foundation for his eventual full-time pivot into real estate.

The turning point came when Richard received a commission check from one of his real estate referrals. “A couple of years later, while working in the corporate world, my real estate agent friend gave me a check from my referrals. I was dumbfounded and thought to myself that this was easy money since I didn’t even do anything! This piqued my interest in real estate,” he exclaims.

This unexpected financial windfall caught his attention, leading him to explore real estate more seriously. Soon after, he transitioned from the corporate world to become a full-time real estate broker.

Building Credibility and Early Wins

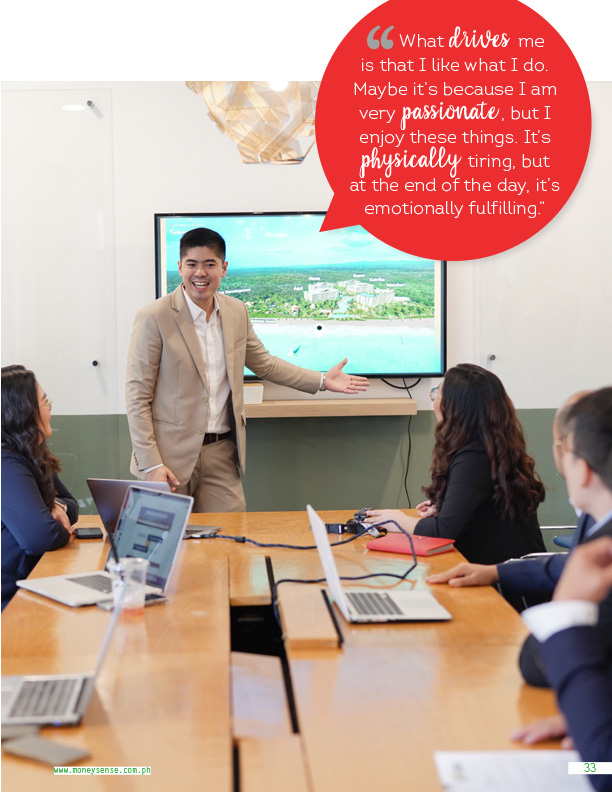

Richard’s early foray into real estate came with its challenges. He made his first million at 23, an impressive feat for someone so young, but earning the trust of older clients wasn’t easy. “Being young and trying to sell to older clients was tough,” Richard admitted. “Many rejected me because I lacked credibility.”

Determined to establish himself, Richard invested heavily in his professional development. He attended seminars, completed training programs, passed the board exam, and earned his license as a real estate broker. These credentials helped him gain clients’ trust and solidified his reputation in the industry.

However, despite his early financial success, Richard learned that wealth could be fleeting if not managed properly. “I didn’t really realize I had hit the million mark because it was gone in a month,” he admits. “I had to pay for many things such as investments and car amortization, among others.” This experience of blowing his first million taught him the value of financial literacy— knowledge he now shares with others through his writing and speaking engagements.

Creating Solutions for OFWs

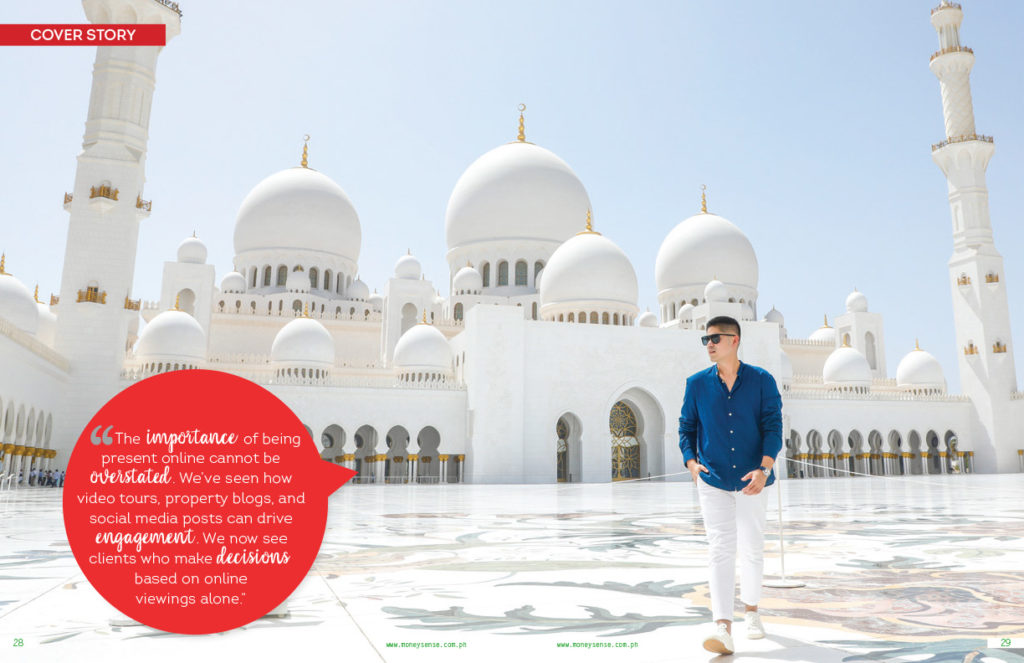

Richard’s big break came when he identified a gap in the market for Overseas Filipino Workers (OFWs) struggling to manage the properties they had purchased. “I found out that OFWs had a difficult time maintaining the properties they had bought,” he shares. Worse, many of these workers had been misled by their agents about market performance, property locations, and return on investment.

Seeing the gap in services provided to OFWs, Richard decided to create a business that would address their needs comprehensively. This led to the founding of Philgems Realty Corporation, a full service investment brokerage firm that not only sells properties but also offers property management, leasing, market research, and investment planning. “Basically, what we did was to make the most out of our clients’ investment,” he explained.

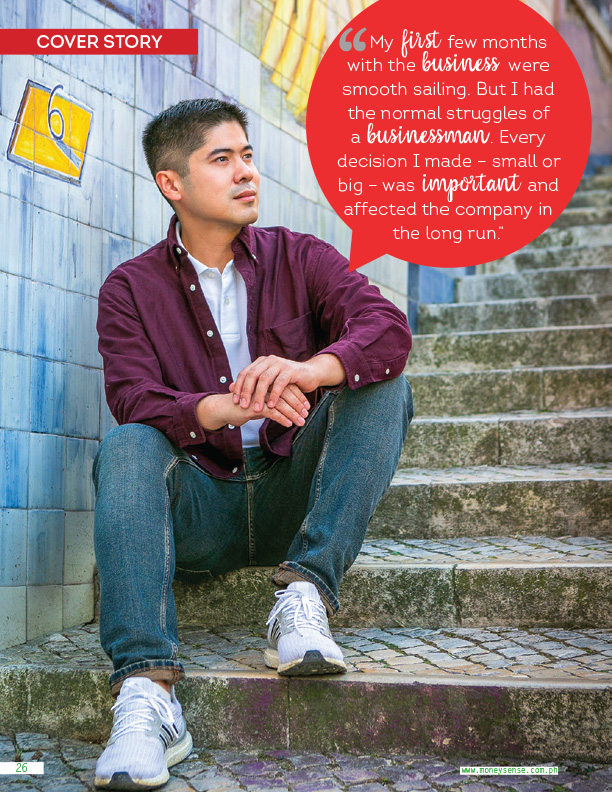

As with any entrepreneurial venture, Richard’s journey with Philgems had its share of challenges. “My first few months with the business were smooth sailing,” he notes. “But I had the normal struggles of a businessman. Every decision I made – small or big – was important and affected the company in the long run.”

Mistakes like over-hiring, overspending on marketing, and expanding too quickly taught him valuable lessons in business management. Richard took these experiences in stride, using them as motivation to continuously improve his business.

These experiences have also reinforced the importance of sound financial management. One of the key lessons he has learned is the value of cash flow. “Cash flow is crucial,” he emphasizes. “I make sure to use my cash wisely, especially in my personal investments.” He also highlights the importance of leveraging payments with no interest and maintaining backup liquidity in case of emergencies.

Advice to the Young

For Richard, leaving a lasting impact goes hand-in-hand with his commitment to guiding the next generation of business leaders and real estate professionals. His advice for Gen Z and other Millennials is simple yet profound:

Do your homework. It is important that you do your research before buying any property. Don’t just depend on your broker. You also have to know the cost and obligation of becoming a property owner, such as paying different taxes, association dues, and maintenance expenses to make sure you earn from it.

Maximize the potential. The good thing about property investment is that you can earn from different income streams, such as capital appreciation, rental, resale, or interest payments, by selling it via a rent-to-own scheme. Do not just buy and wait for the value to increase. Get a property manager to help you lease out the property, which would also help you self liquidate the investment, especially if you have a bank loan.

Prepare to commit. Make sure your mindset is ready. Real estate is a long-term investment you will pay for many years. “We’ve seen many buyers who forfeited their real estate investment and laid their money to waste because they are not financially prepared,” Richard laments. “Also, make sure you have a good credit standing. Real estate investing might sound tedious, but it is definitely worth it.”

Grab Your Digital Copy of MoneySense Now

Table of Contents

Cover Stories

The Millennial Property Entrepreneur – BY EXCEL V. DYQUIANGCO

Building Wealth with Rental Properties – BY CARLA CONCEPCION

Financing Your Real Estate Investments – BY CARLOS GONZALES

The First-Time Homebuyer’s Guide – BY ANDY CRUZ

Plan

How to Pick the Perfect Location for Your Property Investment – BY CARLOS GONZALES

Best Real Estate Marketplaces to Market Your Properties – BY CARLOS GONZALES

Condotels vs. Timeshares – BY ANDY CRUZ

Primer: Pag-IBIG Benefits – BY CARLA CONCEPCION

My Money Story: Navigating Crypto and Real Estate Success – BY ANGELINE VIRAY AS TOLD TO EXCEL V. DYQUIANGCO

My Money Story: Empowering Talents, Building Brands – BY JOSEPH MAX WEBB AS TOLD TO EXCEL V. DYQUIANGCO

My Money Story: From Corporate to Crypto Leader – BY ARLONE ABELLO, AKA COACH MIRANDA MINER, AS TOLD TO EXCEL V. DYQUIANGCO

Invest

Stock Market 101: Stock Market Cycles:

Understanding Boom and Bust Phases – BY CARLOS GONZALES

Real Estate 101: Understanding Property Taxes and

Fees in the Philippines – BY CARLA CONCEPCION

Spend

Best Places to Buy Home Furniture and Décor – BY CARLA CONCEPCION