Putting Your Money in Time Deposits

Putting Your Money in Time Deposits

By Carlos Gonzales

Time deposits have been a favorite financial product of many Filipinos. Apart from real estate, putting one’s long-term savings in time deposits is very typical for most people. So what makes them so attractive? And are they still a good investment, given alternatives like mutual funds, unit investment trust funds, and variable unit-linked insurance products? Here’s a quick primer:

What are time deposits?

Time deposits are interest-bearing bank deposit products that have a fixed term or period, during which they cannot be withdrawn. The advantage, says Jesus Vicente Garcia, Executive Vice President and Branch Banking Group Head of Philippine Veterans Bank, is that “time deposits earn higher interest rates, depending on the amount placed and term.”

In contrast, regular savings and checking accounts are considered demand deposits, as they can be withdrawn at any time. They also offer lower rates. According to Garcia, time deposits are also different from special savings deposit, which also offer higher rates, in that “a special savings deposit is documented with a passbook, but both are subject to documentary stamp tax and final tax.”

How long are the terms?

The minimum term is typically 30 days, with 60, 90, 180, and 360 days (or variations thereof) also available. These days, some banks have also introduced longer-term time deposits, particularly two, three, five, and six years.

Are they available in other currencies?

Time deposits are also available in foreign currencies, usually USD, but increasingly, bigger banks are offering time deposits in AUD, GBP, CAD, EUR, JPY, CHF, and other major currencies.

Do you get a passbook, checkbook, or ATM card?

No. Unlike a savings or checking account, as evidence of ownership, you receive a certificate of time deposit, which usually shows the interest rate, term, and maturity date.

What happens when the term ends?

When it matures, you either withdraw the funds or ask the bank to roll over the deposit for another term.

What are the rates?

Interest rates vary. Most banks usually offer tiered rates for longer terms and higher deposit balances. In other words, interest rates are higher the larger your deposit and the longer the term.

How is the interest earned?

Garcia explains that interest is credited or added to the amount of the principal deposit at the end of the term, “which varies depending on the requirements or requests of the client or the period agreed.” The interest is computed from the day you open the time deposit until the end of the term. For long-term time deposits, some banks credit monthly interest income to your savings account. The interest is net of the applicable final taxes and the documentary stamp tax for some banks, he adds.

What happens if you withdraw before the term?

The bank will charge a pre-termination penalty, such that you receive a much lower interest rate.

What fees and taxes are there?

“There are no fees involved; only the government required taxes, such as the final tax on the interest earned and the documentary stamp tax for the certificate based on the principal amount,” Garcia explains. The documentary stamp tax is P1.00 for every P200.00 while a 20% final tax will be deducted from your interest income. But time deposits of more than five years are tax-exempt.

What’s the minimum deposit?

It depends on the bank. Some have minimum deposits as little as P1,000 while other time deposit products, especially those with longer terms and higher rates, require P100,000 or more.

Are time deposits insured?

Yes, they are insured up to P500,000 per account name by the Philippine Deposit Insurance Corporation (PDIC).

Can you borrow against it?

Yes, you can borrow against your time deposit. Some banks allow you to borrow up to 90% of your time deposit.

How do time deposits compare with investment funds?

Time deposits compete mainly with investment funds like mutual funds, unit investment trust funds (UITFs), and variable unit-linked linked insurance products. Garcia explains, “Investments in mutual funds are investments in companies, the fund manager of which is appointed by the investment company, and thus it is not a traditional bank product. UITFs are trust products of the bank, managed by the trust group of the bank. Since these are investments, these consist of various investors whose resources are pooled, hence documented with a premium fund certificate.”

The main advantages of time deposits is they are insured by the PDIC for up to P500,000 and the interest rate is fixed and guaranteed, so you know exactly how much you will earn. The disadvantage is they may not earn as much as many investment funds, except for money market funds.

When should you put your money in time deposits?

Garcia says, “It depends on what is the financial goal of the depositor or investor. If the financial goal is not immediate such as retirement or education (if one has a newborn) and the client wanted a safe and less risky investment, a long-term time deposit (5 years or more) is the best option, since the interest rate is higher, fixed, compounded on a monthly basis, tax free, and documentary stamp tax free for individuals.”

He adds that a regular time deposit is also appropriate for short-term or immediate financial goals, since the interest is higher unlike regular savings or interest-bearing checking accounts. “Some businessmen place their investible funds in regular time deposits in view of the higher rates, sometimes with the intention of securing a back-to-back loan they use in their business and still keep their funds earning while the interest for the loan is paid out of the earnings from their business,” Garcia explains.

Philippine Veterans Bank offers three long-term time deposits, namely Hyper Savers, where the client sets the goal or the amount of income he wants to earn at the end of the term (five years and one day), and the branch computes backwards how much deposit should be placed in the present time. These are applicable to clients with future plans and thus save up to earn the amount needed after five years. For Maxi Return, the depositor places his or her funds (minimum of P100,000) and earns the applicable interest from the said investment. And for Advantage Plus, the depositor place his funds (minimum of P100,000) with the intention of withdrawing the monthly interest earned via credit to his savings account. The principal amount is withdrawn after five years and one day. This is appropriate for depositors who need funds on a monthly basis.

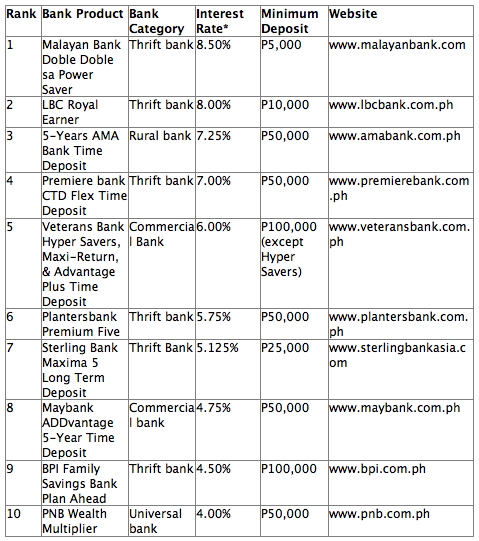

Top 10 5-Year Time Deposits

Say you have P100,000 to put in time deposits and can hold it for five years. Which banks offer the best rates? We checked around and found 10 banks that offer the best bang for the buck.

Disclaimer, you should need to do your own research on each banking institution before opening an account. Rates, based on a P100,000 deposit and held for five years (as of December 31, 2010), may change by the time this issue is out.

paano po process ng time deposit..

Time deposit is good only for short-term goals such as for our emergency fund since time deposit is very liquid (easily be converted into cash). However, people should be aware of the 20% PER ANNUM withholding TAX when you would like to redeem your hard-earned money. In the money game, take note also about another factor or enemy of money which is INFLATION RATE. In the current market condition, the inflation rate in the Philippines is between 4-7 %. So, in order for us to win in the money game, we should put our money in a right vehicle with rate of return HIGHER than the inflation rate!

LBC, which has one of the highest interest rates listed here, had to stop operating. Is the high interest rate they promise to give an indication of their bad financial decision? We might have to think twice before going to these higher interest rates such as Malayan Bank listed at the top.

I agree – depositing your money in banks promising high rates of return is indeed risky.

I agree, that we have to be wary about banks offering high interest rates. But we also have to study the background of the bank and what the product is all about. In the case of LBC, they were offering a high interest rate on a placement for only one year. For other banks, Malayan Bank’s PowerSaver for example, it is a high interest rate of 8.5%, but the term of the placement is 5 years. the money has to be locked in with the bank for a term of 5 years. Just the same with Sterling Bank, they offer a high interest rate but the term of the placement/ deposit has to be 5 years. now, if a bank offers a rate that is so much higher compare to market rate and the term of placement is only 1 year, that might be questionable.

Pag po ba nag time diposite, pwede pang dagdagan ung amount na nilagay mo from the first day na ngdeposit ka?

For example, you time diposited 50,000 can you add 5,000 monthly? Or yung initial mong nilagay, un na yun.? Thanks

@anne

indi mo magagalaw ang monre na nka time deposit. pag windraw mo sila habang nasa duration pa sila ng pinag usapang date (immature date). ma pepenalty ka. at indi din pding mg dagdag. mg open ka nalng ng bagong time deposit account nun

HIGHER RISKS = HIGHER RETURNS. you ll get what i mean

pwede ba ang pension ay mlagay sa time deposit???

pano po pag may time deposit ang uncle ko matanda binata namatay na po siya , may apat siya kapatid , pwede po b nila ma claim yun. any body can help me answer. salamat po.

is the time deposit available for everyone like for a student? thank you

is the time deposit available for everyone like for a student? thank you