Where to Invest in 2013

By Rienzie P. Biolena, RFP®, CWM®

“One of the best in terms of investments…” Mark So , Forex Expert

“Bullish.” Eduardo, “Junie” Banaag, First Vice President, Philamlife

“Everything good for the Philippines…” Mike Ferrer, Fund Managers Association of the Philippines 2012 President

“Optimism for sound returns…” Rina Castelo, Fixed Income Fund Manager, Philam Asset Mgt., Inc.

These are just some of the words experts and authorities say when asked about the prospects for 2013. As investors and individuals become more conscious about their financial security, portfolio, and prosperity, the question “Where do I invest?” is a mantra often said at the onset of a New Year.

By and large, the year 2013 would be another good for investors—another banner year in which economists, fund managers, monetary experts, bankers, businessmen, and finance are all optimistic with. All the major markets— equities, fixed income, real estate and currency—all point north, on the back of an economy that is strongly poised for growth.

As such, investors are on the look-out where to put their money again this year. But before delving into the prospects and details of each major market, it is best to lay out the foundations of the macro environment— the lay of the land—where they all operate.

The Global Macroeconomic Condition

Generally speaking, the global economic environment for 2013 would be on a better footing: the US’s S&P Index is 12.9% up from a year ago, the Chicago Board Options Volatility Index, which is a measure of “investor’s fear” in the US, is down to its lowest levels in five years, and the Euro zone area seems to have averted a sure recession. China, on the other hand, appears to have recovered in the third quarter of 2012, with its economy picking-up— the hard landing which some economists and investors fear not materializing in 2012.

According to Mike Ferrer, President of the Fund Managers Association of the Philippines (FMAP) for 2012 and Managing Director of ATR KimEng Asset Management, “confluence” of improvements in the US and European Region serves as a good backdrop for the Philippine market. “The US housing sector is recovering, the fiscal cliff was averted and corporate balance sheets are looking good. The broad European index, on the other hand, is up by 30% from its lows in June of 2012. China’s growth would be sustained, but all in all, global risks would be muted this year,” says Ferrer.

Junie Banaag, First Vice President and Equities Fund Manager for Philam Life, sees that the US, Europe and China concerns would be continuing, but their respective central banks would be behind them to support and commit themselves to spur economic growth and stabilize their economies. Thus, he is bullish on the prospects again for 2013. “We are on the Philippine stock market’s longest winning streak,” he shares.

The Local Front: The Philippine Economy

With the improving global backdrop, the local Philippine economy is at the forefront of growth and returns on the back of good and sound domestic fundamentals. A combination of the following factors all point for a growing economy for 2013 and beyond: a tame inflation, low debt-to-GDP ratio, healthy fiscal sector, good political capital of the Aquino administration, a growing BPO sector, robust OFW remittances, a strong banking sector, better- than-expected GDP growth, good corporate earnings growth, and a demographic sweet spot.

In fact, the Philippines is now catching the eye of global investors being grouped as one of the as one of the Next 11 or “N- 11” countries that has the high potential of growth and investment returns. Jones Lang Lasalle Leechiu has identified the “VTIP”— Vietnam, Thialand, Indonesia and the Philippines— high growth countries within Southeast Asia.

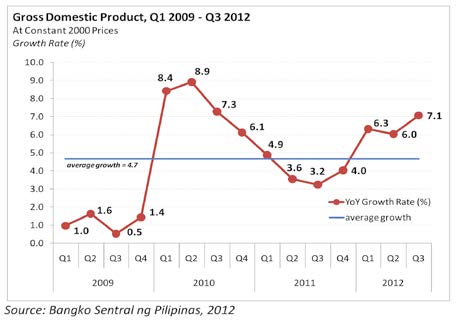

For instance, the Philippine GDP gave a surprising 7.1% growth for the 3rd Quarter of 2012. According to Director Francisco Dakila of the Bangko Sentral ng Pilipinas, this growth is supported by a strong household consumption, continued export recovery, and accelerated government spending.

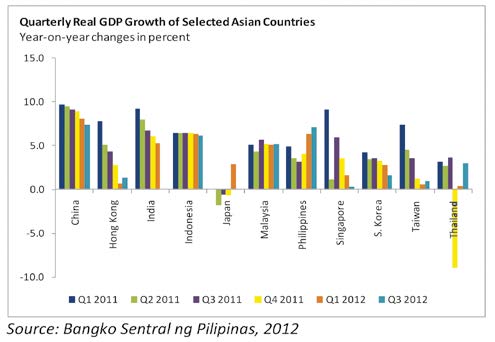

Moreover, GDP growth rate of the Philippines in Asia is among the best performing, second only to China for the same quarter.

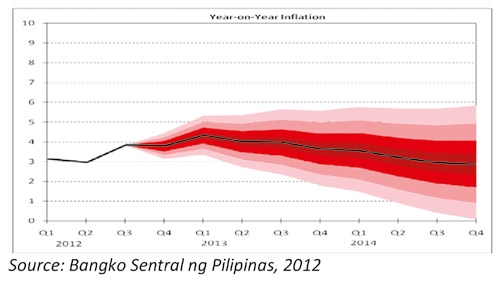

Inflation is tame and well-managed. “It is at an all-time low,” says Ferrer, and is projected by the BSP to be stable and within the target range of 3%-5% for 2013 up until 2014.

Thus, the BSP sees economic growth to continue on the back of construction spending (government and private), manufacturing sector, services sector and the sunshine industries such as BPO and tourism. Household consumption and investments shall also contribute significantly to the economic growth of the country.

Though the lingering concerns in the US and the Euro still continue, the Philippines would be able to withstand them. “The source of resilience from these shocks would be the country’s solid macroeconomic fundamentals, strong domestic demand, a comfortable external payments position, and a sound banking system,” explains by Dr. Francisco Dakila.

Equities Market

With the tide and the winds on the side of the Philippine economy, the local equities market will remain buoyant, up and running for 2013 and even beyond. “We see that a 10%-15% growth per year in the stock market for the next years is possible,” shares Mike Ferrer, of FMAP.

“For 2013, the PSEi might hit 7,000 levels or slightly below, and 7,700 levels for 2014. Although valuations are high now—versus historical of 14x to15x with current P/E now at 16x-17x, and versus other Asian peers—the stock market is fairly valued. Moreover, corporate earnings growth is very strong, and we see it at 15%,” adds Ferrer. Among the recommended sector picks for 2013 are infrastructure, consumer stocks that benefit from a global recovery, smaller and mid-cap stocks with strong earnings growth potential and reasonable value, and real estate.

“I am bullish for 2013,” says Banaag. “For the next six months, the PSEi may hit 6,500 on the back of improving outlook earnings and a re-rating of Philippine stocks in general. A conservative 6.5% estimate for the 2013 GDP growth is expected, on the back of government spending and private & government consumption spending,” he adds.

For Banaag, 2013 sector picks would be infrastructure, restaurants, telecommunications, coal, power generation, multi-asset real estate, and food manufacturing.

Fixed Income Market

For the fixed income market, 2013 is still a good year to invest, albeit with returns hard to squeeze in.

“The local economic fundamentals remain strong with a promising prospect of an investment grade sovereign rating upgrade. 2013 is inclined to remain positive for the local currency bond market as supported by prospects of sustained improvement in the Philippine economic fundamentals namely declining debt and deficit ratio to growth, buoyant remittances that support domestic consumption, government’s growth project initiative (the PPP) to gain traction and the anticipated investment-grade credit rating upgrade to boost demand for lo-cal assets,” says Ms. Rina Castelo, Fund Manager for Philam Dollar Bond, Fund, Inc. and Philam Bond Fund, Inc. “Yet, optimism for sound returns in fixed income investments remain but will probably not replicate previous year’s performance,” she added.

“It would be tougher for investors, as return for GS over the last three years have already been 11%-12%. Now, yield curve is flat, especially in the mid- to long-end of the curve. Investors in the bond market need to be more active and a shortened duration is advised” says Ferrer of FMAP.

For 2013, investors in the fixed income market are to remain cautious of levels and to look for values and be active in trading opportunities in the medium- to long-ends of the yield curve and at the same time managing a shortened duration of their portfolio.

Real Estate Market

“Expect another good year,” Lindsay Orr, Chief Operating Officer of Jones Lang Lasalle Leechiu, says when asked regarding the real estate market for 2013. In the Philippines, the real estate market may be classified in four submarkets, namely the office, residential, retail, and hotel markets.

Growth in each of these markets are seen for the year, with the same factors such as a low inflation, low interest rates, all-time high remittances and a BPO practice boom in the country all contributing to their growth.

“The BPO sector is the backbone for office business, taking up 80% of the supply. But there is a slight change now in the recent take-up, with other businesses taking up more office spaces,” says Orr. His firm sees additional office demand in the off-shoring and outsourcing industry having a growth rate of 20% per year until 2016, requiring an additional office demand of 2.6 million sqm. of new office space.

Jones Lang Lasalle Leechiu also expects that “other demand drivers (e.g. financial services, insurance companies, etc.) to create an additional demand of roughly 100,000-200,000 sqm. of office space.” For 2012, the average rental change for the first half of the year was at 12%, and an increase in rental rates are expected to continue due to a huge demand from the BPO and IT sector.

In the area of residential developments, an additional 150,000 condominium units are expected to be built over the next 3-5 years, 97% of which is in the mid-end range (P1.5M – P10M), with the remaining in the luxury range (P10M and above). Average residential condominium yield as of first half of 2011 is at 6.6% and is expected to rise minimally.

In terms of the retail real estate market which is primarily composed of shopping malls, an additional supply of 640,500 sqm. for Metro Manila and 593,700 for provinces are projected for the first half of 2012 until 2015. Over the next two years, rentals are expected to increase, with the average Metro Manila rentals of P1,028/sqm/mo. going up to P1,080/sqm/mo.

And with tourism being considered a sunshine industry for the economy, the hotel market is projected to cope with the demand. For instance, during 2011, the Philippines accounted for US$3.4B or 33% of 1% in tourist receipts, translating to 3.9M (34% of 1%) of tourist arrivals of the whole global tourism industry. This number of tourist arrivals represents almost a three-fold increase from the year 1999 up to 2011, and hotel room occupancy has been on an upswing from the year 2000 to 2011, with an average hotel occupancy rate of 65.11%.

For 2013, the Department of Tourism is eyeing 5.5 million tourism arrivals. With that demand, there is an estimated 2,900 total launched and planned hotel rooms for 2013, with a total of 15,760 rooms going into 2016. These planned rooms are in the major areas like Makati CBD, Bonifacio Global City, Manila Bay Area, Newport City, Quezon City, Alabang, Ortigas CBD and Bay/Entertainment City. Jones Lang Lasalle Leechiu has, in particular, identified Entertainment City in the reclaimed Manila Bay area of interest, with an expected supply of hotel rooms at 8,050, half the number of the upcoming hotel rooms.

Forex Market

Mark So, founder of Forex Club Asia and foreign currency expert, sees 2013 as one of the best years in terms of investments and prosperity. This is on the back of an improving Philippine economy in general, with the country being a darling of Asia. With the worst in the US financial crisis being over, and economic recovery under way, the Philippine Peso has since recovered from 2008 levels.

Peso Dollar Rate from December 27, 2002 to December 18, 2012

With the extended period of quantitative easing by Ben Bernanke of the US Federal Reserve, the US Dollar is intentionally set to weaken. “It is Bernanke’s effort to stimulate borrowing domestically in US Dollar, not only in the US but internationally as well,” says So.

“With the improving global sentiment, investors right now are now risk on: they are buying into riskier assets not only in stocks, markets, but also in currencies as well,” adds So. Thus, he sees that the Peso shall remain strong versus the Dollar, which shall be nearing P39-P38 in six month’s time, going through end-2013. This represents a further strengthening of the Peso—or the weakening of the Dollar—of 4%- 6.5%. So for those who have the Dollar, it would be recommended to convert and invest in Peso terms for the year.

“The BSP can only do so much in face of the tide and size of money flowing in, looking for places where returns are better,” says So on the BSP’s stance of maintaining a stable Peso to balance off the export sector of the economy. “The US Dollar would still be the dominant currency in the world, and I don’t see it being dislodged in our lifetime. But anybody who wants to buy the dollar for the long-term, however, should buy it now,” he adds.

For 2013, the currencies of choice would be the Australian Dollar (AUD), New Zealand Dollar (NZD), the British Pound Sterling (GBP), the Euro (EUR) and the Canadian Dollar (CAD) which will appreciate between 1.25% – 2.5% for 2013. “The Japanese Yen, along with the US Dollar, shall continue to weaken double the rate of the latter,” says So.

It’s More Fun In The Philippines

To borrow the tagline from the Department of Tourism, “It’s more fun in the Philippines.” With all the sectors, experts and authorities being optimistic and more comfortable on the economy— on a global, regional, and local levels—2013 is another profitable year to make more returns.

Sources:

Dakila, Francisco. The Philippine Economy: Developments, Prospects and Challenges, BSP Center for Monetary and Financial Policy, 5 December 2012, Makati.

www.rappler.com/business/11454-philippineseyes- 5-5-m-tourists-in-2013

Jones Lang Lasalle Leechiu. Property Market Overview, November 2012. Bloomberg

I attended one of Mark So’s Forex seminars early this year. One could see his optimism in conveying that 2013 is a good financial year for Forex. The confidence in him in his speech delivery is surely contagious. I myself caught that feverish vibe.

hi! where can individual investors retrieve the data of the latest yield curves and interest rates?